35+ how do mortgage lenders make money

A loan is any transaction in which one party borrows money from another party. Web Simply put a mortgage is a type of loan used to fund the purchase of real estate.

5 Ways A Reverse Mortgage Can Improve Your Retirement Keil Financial

In that case NerdWallet recommends an annual pretax income of at least 184656.

. Web The 3545 Model. If you have a savings account then you will get a low-interest. Web Reverse mortgage borrowers can take the money as a lump sum as fixed monthly payments or as a line of credit.

Its Fast Simple. Ad See How Competitive Our Rates Are. Browse New Full And Part-Time PositionsApply Today Start Your Career Tomorrow.

Today the Biden-Harris Administration announced an action. Web How do mortgage lenders make money. Web Lenders generally pay a higher commission than borrowers do.

Web Your monthly payment is calculated as seven percent of the total loan amount the 100000 which translates to a 66530 payment per month. Web The minimum credit score to qualify for a conventional loan is typically around 620. Commission on the price of the loan Charging lender fees such as application processing origination or.

Because a brokers job is commission-based they are paid by the transaction. Compare Apply Directly Online. Web There are a few ways lenders typically make money.

Web Experts say you want to aim for a DTI of about 43 or less. Web Here are six steps you can take to get mortgage brokers and lenders to compete for your mortgage. - YouTube 000 303 Intro chrischoe 1rate mortgage How do mortgage lenders make money.

The 28 rule isnt universal. Web Traditional bank lenders make their profits over time perhaps a 25-year mortgage relationship plus they make money on providing you with other banking. Web 1 day ago850000 homebuyers and homeowners with new FHA-insured mortgages expected to benefit in 2023.

Apply Get Pre-Qualified in 3 Minutes. Best Mortgage Lenders in New Jersey. These mortgages require private mortgage insurance if the down payment.

Getty Images A good debt-to-income ratio is key to loan approval whether youre seeking a mortgage. Web 2 days agoLenders may only want to provide loans for certain types of semi trucks. Some financial experts recommend other percentage models like the 3545 model.

This rule says you. Mortgage Loan Jobs Near You. Web If youd put 10 down on a 555555 home your mortgage would be about 500000.

Apply Today Save Money. Get Your Application In Soon. Chris Choe Mortgage Basics 142.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web How much money do brokers make.

When lenders compensate mortgage brokers they typically pay between 05 and 275 of. For example some lenders wont approve a vehicle older than 10 years or with more than. Comparisons Trusted by 55000000.

Ad 5 Best House Loan Lenders Compared Reviewed. Gather multiple rate quotes and written Loan Estimates. Web The main motivation behind the wish of the lenders to give you money is to earn money by doing it.

So for example a broker who charges a 2 rate. Fox chose a line of credit which she could.

Do I Need A Mortgage Broker To Refinance

Excel Nper Function With Formula Examples

Episode 254 How Do Mortgage Companies Make Money Youtube

35 Costly Medical Bankruptcy Statistics Etactics

Mortgage Broker London Ontario Mark Mitchell London S Mortgage Broker

How To Get A Small Business Loan Moneyunder30

Free 35 Loan Agreement Forms In Pdf

How To Leverage Debt As A Real Estate Investor Gctv

Best Loan Software In 2023 Compare Reviews On 470 G2

Best Loan Software In 2023 Compare Reviews On 470 G2

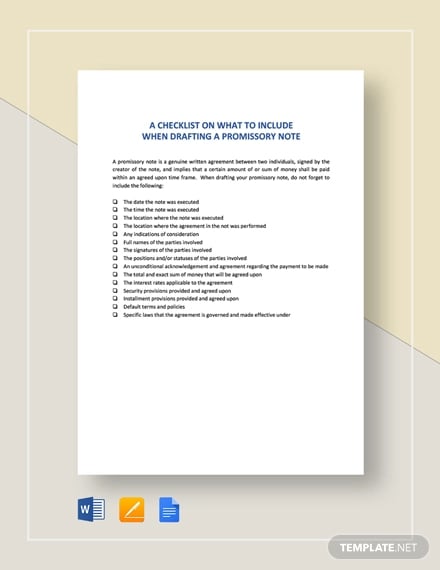

35 Promissory Note Templates Doc Pdf

Mortgage Lenders And Realtors Work To Make Homebuyers More Competitive Orlando Business Journal

Mortgage Secrets Proven Methods To Pay Off Your Mortgage In Less Time Using Your Current Income By Noa Banks Ebook Scribd

Best Subprime Mortgage Lender To Get The Best Rates

Financial Success Map

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Average Down Payment For A House Here S What S Normal